Ctrl + F is the shortcut in your browser or operating system that allows you to find words or questions quickly.

Ctrl + Tab to move to the next tab to the right and Ctrl + Shift + Tab to move to the next tab to the left.

On a phone or tablet, tap the menu icon in the upper-right corner of the window; Select "Find in Page" to search a question.

Share UsSharing is Caring

It's the biggest motivation to help us to make the site better by sharing this to your friends or classmates.

Investment

Explore the world of investments, covering stocks, bonds, real estate, and more, to help make informed financial decisions and grow your wealth.

investment

portfolio

stocks

bonds

real estate

risk

return

diversification

asset

mutual funds

dividends

securities

capital

retirement

trading

What are the benefits of investing in Mutual Fund?

- Professional Management

- Convenience

- Tax Efficiency

- All of the above

What does the term "liquidity" mean in the context of investments?

- The ability to quickly convert an investment into cash without significant loss of value

- The value of an investment at the time of purchase

- The total value of all investments combined

- The interest earned on an investment

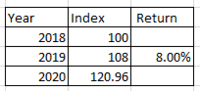

What is the Return in Year 2020?

- 12%

Changes in monetary policy occur when the Federal Reserve

- changes spending levels to affect the economy.

How is a 401k different from an individual retirement account (IRA)?

- A 401k is created by an employer who may match contributions.

Which statement best describes how inflation affects the value of investments over time?

- It decreases the value of money.

What does diversification in investment refer to?

- Putting all your money into a single investment

- Spreading investments across different assets

- Investing only in international markets

- Investing in high-risk assets

What is the difference between a traditional IRA and a Roth IRA

- Contributions to a traditional IRA may be tax-deductible, while contributions to a Roth IRA are not tax-deductible but withdrawals in retirement are tax-free

- Traditional IRA provides higher returns than Roth IRA

- Roth IRA has mandatory minimum withdrawals at a certain age, but traditional IRA does not

- Traditional IRA has no contribution limit, while Roth IRA has a contribution limit

What is a dividend in the context of investing?

- A payment made by a corporation to its shareholders, usually in the form of cash or additional shares

- An increase in the value of an investment

- A tax on investment profits

- An investment's initial purchase price

On January 1, 2009, Annie Companypurchased 20% of the outstanding ordinary shares of Duke Company forP4,000,000 of which P1,000,000 was paid in cash and P3,000,000 ispayable with 12% annual interest on December 31, 2010. Annie also paidP500,000 to a business broker who helped find a suitable business andnegotiated the purchase.At the time of acquisition, the fairvalue of Duke's identifiable assets and liabilities were equal to theircarrying values except for an office building which had a fair value inexcess of book value of P2,000,000 and an estimated life of 10 years.Duke's shareholders' equity on January 1, 2009 was P 13,000,0000.During2009, Duke reported net income of P5,000,000 and paid dividend ofP2,000,000. What amount of income should Annie Company report for 2009as a result of the investment?

- 620,000

- 810,000

- 885,000

- 960,000

A raw material or primary agricultural product that can be bought and sold, such as copper or coffee

- CD

- Dividend

- Commodity

- Bond

Which factors can affect a stock's price? Check all that apply.

- -the company's financial health-market performance-the economy

Real Estate is an example of....

- savings

- investment

What is an index fund?

- A type of mutual fund or ETF designed to replicate the performance of a specific market index

- A government-issued investment bond

- An investment in international markets

- A low-risk individual stock investment

Which can be traded in a commodities market?

- oil

Bulk Company purchased a P1,000,000 ordinary life insurance policy on its president. The policy year and Bulk's accounting year coincide. Additional data are available for the year ended December 31, 2009:Cash surrender value, 1/1 43,500Cash surrender value, 12/31 54,000Annual advance premium paid 1/1 20,000Dividend received 7/1 3,000Bulk Company is the beneficiary under the life insurance policy. How much should Bulk report as a life insurance expense for 2009?

- 6,500

- 9,500

- 17,000

- 20,000

John is an investor and he is considering diversification. What does diversification mean in this context?

- The fixed amount of money that John agrees to pay the bondholders.

- The current price of John's asset.

- The process of John owning different investments that tend to perform well at different times.

- The amount of money John earned on a bond in one year.

A sudden and extreme downturn in stock performance/value

- Index

- Crash

- Penalty

- Risk

Which is true about investments and risk?

- Every investment carries some degree of risk.

A share of stock represents a fractional ownership of a company, which an individual buys in hopes of earning money and a company issues in order to raise funds.

- Stock

Jackson is a shareholder in a company. He recently received a portion of the company's profit. What is this called?

- a dividend

- preferred stock options

- a balanced checkbook

- a stock option divided in half

Investors nearing retirement will typically shift their investment portfolios to include ________ risk investments.

- lower

- moderate

- higher

- None of the above

What is a value stock in investing?

- A stock with very low volatility

- A stock that is perceived to be undervalued and trading at a lower price relative to its fundamentals

- An ownership share in a company

- A stock with consistently high dividends

When you have money to invest and you are concerned with how safe your investment will be (so that you don't lose money), with which concept are you concerned?

- Return

- Risk

Your risk tolerance for investing should be determined by these two factors:

- Your stocks and bonds

- Your time horizon and when you will need access to the money

- Your debits and credits

- Your education level and ethnicity

Why should Noah buy a mutual fund instead of one stock?

- [No Answer]

Julie wants to buy a car and is deciding how she should invest her money. To best meet her needs, she should

- invest in US savings bonds because of its short term.

What is a 401(k) plan?

- A type of individual retirement account

- A government-issued investment bond

- A retirement savings plan sponsored by an employer, allowing employees to save and invest a portion of their salary before taxes are taken out

When an insurance company needs to provide a payout, the money is removed from

- a pool of funds

A debt security in which the issuer (company or government) owes the holders (or investor) a debt and, depending on the terms of the bond, is obliged to pay the bondholder interest (the coupon) and/or to repay the principal at a later date, termed the bond maturity.

- Bonds

What is a hedge in investment?

- An investment made to reduce the risk of adverse price movements in an asset

- An aggressive investment strategy

- An investment in foreign currencies

- An investment in precious metals

A low-fee portfolio of stocks chosen to track or mimic a stock market index, thereby removing the human element of investing because no one is choosing the individual stocks

- Index Fund

On October 1, 2009, York Company purchased 4,000 of the P1,000 face value, 10% bonds of Dell Company for P4,400,00 which includes accrued interest of P100,000. The bonds, which mature on January 1, 2016, pay interest semiannually on January 1 and July 1. York uses the straight-line method of amortization and appropriately records the bonds as a long-term investment. The bonds should be shown on York's December 31, 2009 balance sheet at:

- 4,284,000

- 4,288,000

- 4,300,000

- 4,400,000

William is not generally a risk-taker, but he knows he may need to step out of his comfort zone to make enough money for retirement.Which investment option would best meet William's needs?

- a commodity

What is a derivative in investing?

- An ownership share in a company

- A low-risk investment option

- A financial contract whose value is derived from the value of an underlying asset, index, or rate

- A type of government bond

What is the meaning of "inflation" in investing?

- The rate at which the general level of prices for goods and services is rising and, subsequently, the purchasing power of currency is falling

- The increase in the value of an investment

- The total value of all investments combined

- The interest earned on an investment

What is a target-date fund?

- A mutual fund that automatically adjusts its asset allocation over time based on a specified target retirement date

- An investment in government-issued bonds

- An investment in international markets

- A low-risk individual stock investment

An index that tracks 30 large, generally successful and reliable companies.

- Dow Jones

What is the meaning of a "cyclical stock" in investing?

- A stock whose price is influenced by the economic cycle, often following the performance of the overall economy

- A stock with very low volatility

- A stock with consistently high dividends

- A stock of a newly established company

What type of investment provides diversification rather than only holding stocks and bonds, has less volatility than stocks, and does not move in tandem with stocks?

- Bonds

- Mutual Funds

- Real Estate

- ETFs

What is real estate investment?

- Investing in properties such as houses, apartments, or commercial buildings to generate rental income or capital appreciation

- Investing in shares of real estate companies

- Investing in government-issued real estate bonds

- Investing in high-yield stocks

Once stocks are on the market, which best explains how their prices are set?

- Prices fluctuate on the basis of demand.

What is an accredited investor in the context of investments?

- An individual or entity that meets specific income and net worth criteria, allowing them to invest in securities not registered with regulatory authorities

- An individual investing in government-issued bonds

- An individual investing in international markets

- An individual with a low-risk investment portfolio

What is the role of a fiduciary in investment?

- Acting in the best interest of their clients when managing investments and providing financial advice

- Providing investment advice to clients

- Executing trades on behalf of clients

- Ensuring tax exemptions on investments

What is an ETF (Exchange-Traded Fund)?

- A type of investment fund and exchange-traded product, with shares that are tradeable on a stock exchange

- A government-issued investment bond

- A fixed-term deposit

- A company's stock

What is the meaning of "diversifiable risk" in investing?

- Risk that can be reduced through diversification by spreading investments across different assets or sectors

- Risk associated with a specific investment, such as a stock or bond

- Risk associated with fluctuations in the overall market

- Risk that cannot be mitigated through diversification

In the world of investments, what is the term used to describe the potential for financial loss?

- Stock

- Reward

- Risk

- Real Estate

The declared interest of the bond is called the ______ rate.

- bonded

- coupon

- agreed-upon

- declaration

The practice of putting a fixed amount into an investment over a period of time, regardless of the price of that investment

- Dollar Cost Averaging

What is an IPO (Initial Public Offering)?

- A government-issued investment bond

- The first sale of stock by a company to the public, marking the transition from private to public ownership

- An investment in international markets

- A low-risk investment option

Mutual Funds are owned by ________ , but are controlled by ________ .

- managers, managers

- shareholders, the government

- the people, the people

- shareholders, managers

Recurring deposit is also a pyramid scheme

- True

- False

Variable interest rate__________

- moves up or down depending on the financial market

- remains the same for the period of the loan.

What does the term "long position" mean in trading?

- A position that is held for a short period

- A position where an investor buys a security with the expectation that its price will rise

- A position where an investor sells a security without owning it

- A position that is not related to trading

Which type of insurance policy would someone get to protect others only?

- life insurance

Eve Company owns 50,000 ordinary sharesof Blend Company, which has several hundred thousand shares publiclytraded. These 50,000 shares were purchased by Eve in 2007 for P100 pershare. On August 30, 2009, Blend distributed 50,000 stock rights toEve. Eve was entitled to buy one new share of Blend Company for P90cash and two of these rights. On August 30, 2009, each share had amarket value of P 132 ex-right, and each right had a market value ofP18. What cost should be recorded for each new share that Eve acquiredby exercising the rights?

- 90

- 114

- 126

- 132

Market value of a company's outstanding shares calculated by multiplying the current share price by number of shares outstanding

- Market Capitalization

On January 1, 2009, Cart Companypurchased Fae Company 9% bonds with a face amount of P4,000,000 forP3,756,000 to yield 10%. The bonds are dated January 1, 2009, mature onDecember 31, 2018, and pay interest annually on December 31. The cart usesthe interest method of amortizing bond discount. In its incomestatement for the year ended December 31, 2009, what total amountshould Cart report as interest revenue from the long-term bondinvestment?

- 344,400

- 360,000

- 375,600

- 400,000

What is Investment banking

- It is a bank

- It is a type of banking

- NFT

- None of these

What is the definition of premium?

- The amount paid for an insurance policy

Which investment is the most risky?

- bond

- stock

- mutual fund

- savings account

What is an income and expenditure account?

- To determine exactly how much an individual or business has to invest, it is a good idea to prepare a weekly.

- it the difference between fixed and variable interest rate.

The images show what happened to two people who invested $1,000. Which investment advice would Gale most likely give to Alex?

- Spread your investments in several different areas.

If two people are invited to invest and become partners in a business, the business owners will then ________ the risk.

- Share

The ratio of money gained or lost on an investment relative to the amount of money invested; also known as return on investment (ROI).

- Rate of Return

Why does John, a long-term investor, prefer to invest his money for a longer period instead of seeking short-term gains?

- John believes in giving time for the market to regulate itself. He also trusts the historical data which shows that the market rises over time, even with occasional downturns and fluctuations.

What is the role of a custodial account in investing?

- Safeguarding and administering financial assets on behalf of clients

- Managing investments on behalf of a minor, typically under the supervision of a parent or guardian

- Providing investment advice to clients

- Ensuring tax exemptions on investments

Market value of all of a company's outstanding shares, calculated by multiplying the Current Share Price by Number of Shares.

- Market Capitalization

What is one thing you should save for?

- [No Answer]

On April 1, 2009, Zen Company purchased40% of the outstanding ordinary shares of Ying Company for P10,000,000.On that date, Ying's net assets were P20,000,000 and Zen cannotattribute the excess of the cost of its investment in Ying over itsequity in Ying's net assets to any particular factor.Ying's2009 net income is P5,000,000. Zen plans to retain its investment inYing indefinitely. Zen accounts for its investment in Ying by theequity method. The maximum amount which could be included in Zen's 2009income before tax to reflect Zen's "equity in net income of Ying" is:

- 1,400,000

- 1,500,000

- 1,850,000

- 2,000,000

The type of investment account that people create for after they finish working is known as a

- Certificate of Deposit

- Savings account

- Mutual fund

- Retirement account

On January 1, 2009, Camelot Company established a sinking fund in connection with its issue of bonds due in 2014. A bank was appointed as an independent trustee of the fund. On December 31, 2009, the trustee held P364,000 cash in the sinking fund account representing P300,000 in annual deposits. How should the sinking fund be reported in Camelot's balance sheet on December 31, 2009?

- No part of the sinking fund should appear in Cameron's balance sheet.

- P64,000 should appear as a current asset.

- P364,000 should appear as a current asset.

- P364,000 should appear as a noncurrent asset.

A bond's coupon rate is 6.5% and inflation rate was 4.0% in the same year. What is the bond's real return?

- 10.5%

- 4.5%

- 2.5%

- 2.4%

Vacation Company is a golf course developer that constructs approximately 5 courses each year. On January 1, 2009, Vacation Company agreed to buy 5,000 trees on January 1, 2010, to be planted in the courses it intends to build. In recent years, the price of trees has fluctuated wildly. On January 1, 2009, Vacation Company entered into a forward contract with a reputable bank. The price is set at P500 per tree.The derivative forward contract provides that if the market price on January 1, 2010, is more than P500, the difference is paid by the bank to Vacation. On the other hand, if the market price is less than P500, Vacation will pay the difference to the bank. This derivative forward contract was designated as a cash flow hedge. The market price on December 31, 2009, and January 1, 2010, is P800. The appropriate discount rate is 8%, and the present value of 1 at 8% for one period is .926.On December 31, 2009, Vacation Company shall recognize a derivative asset at:

- 694,500

- 750,000

- 1,389,000

- 1,500,000

___ on public offer

- follow

Compared to high-risk investments, low- and medium-risk investments are in higher demand because they

- are considered safer.

What is the meaning of "capital gain" in investing?

- The profit made from the sale of an asset, such as stocks or real estate, at a higher price than the purchase price

- The loss incurred from the sale of an asset

- The interest earned on an investment

- The initial investment amount

What is the meaning of "market capitalization" in investing?

- The total value of all investments combined

- The total value of a company's outstanding shares, calculated by multiplying the share price by the number of shares

- The initial offering price of a stock

- The interest earned on an investment

What is a margin call in investing?

- A demand from a broker for additional funds or securities to cover a shortfall in an account due to adverse price movements

- An ownership share in a company

- An ownership share in a real estate property

- An investment in foreign currencies

What is a no-load mutual fund?

- A mutual fund that does not charge a sales commission or front-end load to buy shares

- A government-issued investment bond

- An investment in international markets

- A low-risk individual stock investment

The nominal interest rate could best be described as the rate.

- stated

How can an insurance company make a profit by taking in premiums and making payouts?

- The value of the premiums the company takes in is higher than the value of the payouts it makes.

Measure the likelihood that a bondholder will be paid back. The higher the rating for a bond, the lower the coupon rate for that bond.

- Bond ratings

_________ stocks give you both money and votes in company dealings

- Common

On July 1, 2009, Dino Company purchased30,000 shares of Mammoth Company's 100,000 outstanding ordinary sharesfor P200 per share. On December 15, 2009, Mammoth paid P400,000 individends to its ordinary shareholders. Mammoth's net income for theyear ended December 31, 2009 was P1,200,000, earned evenly throughoutthe year. In its 2009 income statement, what amount of income from thisinvestment should Dino report?

- 60,000

- 120,000

- 180,000

- 360,000

The type of investment account that allows investors to own shares or have "partial ownership" in a particular company is known as (a)...

- Certificate of Deposit

- Mutual fund

- Retirement account

- Stocks

Why should investors know the difference between nominal and real interest rates?

- to recognize the effects of inflation

A share of the value of a company, which can be bought, sold, or traded as an investment and which gives the investor small partial ownership of the company

- Stock

Three Kings Company invested in shares of Eastern Company acquired as follows: NUMBER OF SHARES COST2007 22,500 1,800,0002008 37,500 3,300,000In2009, Three Kings Company received 60,000 rights to purchase Easternshare at P80. Five rights are required to purchase one share. At issuedate, rights has a market value of P4 each and share was sellingex-right at P96. Three Kings Company used rights to purchase 9,000additional shares of Eastern Company and allowed the rights notexercised to lapse. In determining the stock rights exercised, assumethe use of the first-in, first-out method. The amount to be debited toinvestment account for the purchase of the 9,000 additional shares is:

- 720,000

- 824,000

- 871,200

- 873,000

What are the range of investment options available

- investment accounts and property

- cryptocurrency and debentures

- superannuation and managed funds

- All the above

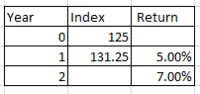

What is the Index in Year 2 (rounded to two decimal places)?

- 138.25

- 140.44

- 141.25

- 144.44

The type of investment account that is created with the promise that the investor will earn significant interest on their money is known as a...

- Mutual fund

- Stocks

- Retirement account

- Bonds

What is the role of dividends in investment?

- Providing a portion of a company's profits to shareholders as a form of return on their investment

- Increasing the value of an investment

- Offsetting the risk of an investment

- Ensuring a tax-free investment

Who is an entrepreneur?

- a person who sets out to build a successful business in a new field. An entrepreneur’s methods are sometimes regarded as innovative

- A person who makes something that is not innovative.

An investment of $3,000 is made at a simple annual interest of 5%. How much must additional money be invested at an annual simple interest rate of 8% so that the total annual interest earned is 7.5 of the original amount you invested?

- $ 5000

- $ 3000

- $ 4000

- $ 6000

On January 1, 2009, Riyadh Companypurchased serial bonds with the face value of P3,000,000 and stated 12%interest payable annually every December 31. The bonds mature at anannual installment of P1,000,000 every December 31. The rounded presentvalue of 1 at 10% for: One period 0.91 Two periods 0.83 Three periods 0.75What was the market price of the serial bonds on January 1, 2009?

- 3,060,000

- 3,045,000

- 3,106,800

- 3,149,400

A low-fee portfolio of stocks chosen to track or mimic a stock market index, thereby removing the human element of investing.

- Index Fund

Which are common mistakes people make when investing? Check all they apply.

- They invest more money than they can afford.They focus heavily on familiar investment opportunities. They hold onto investments longer than they should to recoup losses. They put all of their money into one kind of investment at a time

A federal program that provides monthly benefits to millions of Americans, including retirees, military families, surviving families of deceased workers, and disabled individuals

- Social Security

Value of a mutual fund increases with fall in market

- Yes

- No

An investment with a stable and predictable history will most likely have

- low risk.

The process of setting money aside to increase wealth over time for long-term financial goals such as retirement

- Investing

What is the role of a market maker in investments?

- Providing investment advice to clients

- Executing trades on behalf of clients

- Facilitating the buying and selling of securities by providing liquidity in the market

- Ensuring tax exemptions on investments

What is asset allocation in investment?

- Distributing investments across various asset classes to balance risk and return

- Investing only in stocks

- Investing only in bonds

- Investing only in real estate

Degree of uncertainty on how likely the investor is to make money on an investment

- Risk

An index of 500 large cap companies chosen based on 8 factors, including market capitalization, location, and industry.

- S&P 500

Bonds issued by the U.S. Treasury with a maturity of more than 10 years; generally considered risk-free investments.

- Treasury Bonds

On January 1, 2009, Man Company adopted a plan to accumulate P5,000,000 by January 1, 2014. Man plans to make 5 equal annual deposits that will earn interest at 9% compounded annually. Man-made the first deposit on December 31, 2009. The future value of an ordinary annuity of 1 at 9% for 5 periods is 6.52. What amount must be deposited annually at the compound interest to accumulate the desired amount of P5,000,000?

- 609,756

- 664,894

- 766,871

- 836,120

List one reason why companies would like you to purchase stock

- [No Answer]

What is a blue-collar investment?

- An investment in industries or companies associated with manual or industrial work

- An investment in government-issued bonds

- An investment in high-tech industries

- An investment in international markets

A loan to a company or government is called...

- saving

- stock

- bond

- index funds

After he bought a new car, Nelson purchased car insurance. He must pay $75 each month for the plan.Later that month, Nelson caused a car accident when he lost control of his vehicle. He was required to pay the first $500 of his repair costs, and then the insurance company covered the rest.Read the passage about Nelson's car insurance.What is the $75 payment Nelson must make each month?

- premium

What is the meaning of P/E ratio in investing?

- Price-to-Earnings ratio, a valuation ratio calculated by dividing the market price per share by the earnings per share

- A measure of portfolio earnings

- A measure of portfolio equity

- A measure of dividend yield

Compared to a short-term investment, a long-term investment is generally considered

- to be equally as risky.

Why is FD better than RD ?

- You end up bankrupt

- You get higher returns

- Bank pays you

- You get NFTs

An investing tool for individuals to earmark funds specifically for their retirement

- Individual Retirement Account (IRA)

The ratio of money gained or lost on an investment relative to the amount of money invested; also known as return on investment (ROI)

- Rate Of Return

Imagine you are a financial analyst studying the stocks of Apple Inc. Apple Inc. would be classified as a large cap stock if its market value exceeds what amount?

- Apple Inc. would be classified as a large cap if its market value exceeds $1 million.

- Apple Inc. would be classified as a large cap if its market value exceeds $10 billion.

- Apple Inc. would be classified as a large cap if its market value exceeds $100 billion.

- Apple Inc. would be classified as a large cap if its market value exceeds $1 billion.

Which of these affect real investment value? Check all that apply.

- Fees and expensesnominal interest ratetaxes

A retirement savings plan sponsored by an employer which lets workers save and invest a piece of their paycheck before taxes are taken out. Taxes aren't paid until the money is withdrawn from the account.

- 401(k) Retirement Plan

What is the meaning of "deflation" in investing?

- The decrease in the general price level of goods and services, often accompanied by reduced spending and economic slowdown

- The rate at which the general level of prices for goods and services is rising

- The increase in the value of an investment

- The interest earned on an investment

A retirement account, offered in some job sectors or companies, that an employer maintains to give an employee a fixed payout at retirement

- Pension

What is the meaning of a "short position" in investing?

- A position where an investor sells a security without owning it, anticipating its price will fall and can be bought back at a lower price

- A position where an investor buys a security with the expectation that its price will rise

- A position that is held for a short period

- A position that is not related to trading

A mutual fund is

- An investment in a diversified group of stocks

- The money left over when reinvested into the company

- An account that guarantees a fixed rate of return

- Exclusively for retirement accounts

John is planning for his retirement and his financial advisor suggested an IRA. What is an IRA?

- Securities that represent ownership in a corporation; must be issued by a corporation.

- Shares issued by a company which represent ownership in it. Ownership of property, usually in the form of common stocks.

- A tax-deferred account to which an eligible individual like John can make annual contributions up to $3,000.

- A rise in the prices of goods and services, often equated with loss of purchasing power

An entrepreneur keeps backup funds in a savings account so that if their business experiences a loss, they will be able to recuperate. What type of risk management is this an example of?

- reducing risk

What is the significance of due diligence in investment?

- Thorough research and analysis conducted before making an investment decision to ensure it meets the desired criteria and is a sound financial choice

- Investing without proper consideration of risks

- Investing based on market speculation

- Investing only in high-risk assets

A bond, often having tax advantages for individual investors, issued by a state or local government which typically uses the loan to pay for public works to benefit its citizens

- Municipal Bond

What is a certificate of deposit (CD)?

- A low-risk investment option

- A type of government bond

- A time deposit offered by banks with a fixed term, typically providing a higher interest rate than regular savings accounts

- A high-risk individual stock investment

The interest payment on a coupon bond. Example: A $1,000 bond with a 5% coupon would pay the bond investor $50 per year until maturity

- Coupon

Bonds issued by state and local governments which often have tax advantages for individual investors.

- Municipal Bonds

What can a savings account be used for?

- [No Answer]

On February 15, 2009, Bart Companypurchased 20,000 shares of Homer Company's newly issued 6% cumulativeP75 par preference share capital for P1,520,000. Each share carried onedetachable share warrant entitling the holder to acquire at P10, oneordinary share of Homer Company. On February 15, 2009, the market priceof the preference share ex-warrant was P72 and the market price of theshare warrant was P8. On December 31, 2009, Bart sold all the sharewarrants for P205,000. The gain on the sale of the share warrants was:

- 0

- 5,000

- 45,000

- 53,000

A United States federal program of social insurance and benefits developed in 1935. The Social Security program's benefits include retirement income, disability income, Medicare and Medicaid, and death and survivorship benefits.

- Social Security

What does the term "bonds rating" refer to in investing?

- The initial offering price of a bond

- The maturity date of a bond

- An evaluation of the creditworthiness and risk associated with a bond issuer, determining the bond's risk level and interest rate

- The interest earned on a bond

An employer contribution made to their employees' 401(k) plan based on individual employee's contributions

- 401(K) Match

What is the primary reason to issue stock?

- To help investors earn a higher rate of return

- To raise money to grow the company

- To distribute the risk of bankruptcy across more investors

- To increase investor awareness of the company

EE Bonds & I Bonds are similar in that. . .

- build cash

- similar interest rates

- You can cash in after one year

Who spreads awareness about mutual funds in india ?

- SBI

- ICICI

- AMFI

- Bank of Baroda

A bond, generally considered to be a risk-free investment, issued by the U.S. Treasury with a maturity of more than 10 years

- Treasury Bond

This bond is guaranteed to double in 20 years

- EE Bonds

A pension is a retirement account that an employer maintains to give an employee a fixed payout at retirement.

- Pension

What is a commodity in the context of investing?

- A type of government bond

- An ownership share in a company

- A raw material or primary agricultural product that can be bought and sold, such as gold, oil, or coffee

- A low-risk investment option

What is a hedge fund?

- A low-risk investment option

- An investment fund that pools capital from accredited individuals or institutional investors and invests in a variety of assets

- A type of government bond

- An investment in foreign currencies

What is a 403(b) plan?

- An investment in government-issued bonds

- A retirement savings plan for employees of certain non-profit organizations, such as schools and hospitals, allowing pre-tax contributions and tax-deferred growth

- A government-issued investment bond

- A low-risk individual stock investment

Which is an example of a short-term investment?

- bonds

An index of 500 large cap companies chosen based on their size, industry, and other factors, used to represent the entire market

- S&P 500

An individual retirement account that allows a person to set aside pre-tax income (up to a specified amount). Earnings are tax-deferred but taxes are paid when withdrawals are made beginning at age 59 1/2 or later (or earlier, with a 10% penalty).

- Traditional IRA

A market where shares in corporations are bought and sold through an organized system.

- Stock exchange

What is FPO

- Final private offer

- First public order

- Final public offer

- None of the above

In January 2009, Fatty Company acquired20% of the outstanding ordinary shares of David Company for P8,000,000.This investment gave Fatty the ability to exercise significantinfluence over David. The book value of the acquired shares wasP6,000,000. The excess of cost over book value was attributed to adepreciable asset which was undervalued on David's balance sheet andwhich had a remaining useful life of ten years.For the yearended December 31, 2009, David reported net income of P1,800,000 andpaid cash dividends of P400,000 and thereafter issued 5% stockdividend. What is the proper carrying value of Fatty's investment inDavid at December 31, 2009?

- 7,720,000

- 7,800,000

- 8,000,000

- 8,080,000

New York Stock Exchange -- the world's largest stock exchange.

- NYSE

Capital Markets allow companies to raise money via (you may choose more than one answer)

- Bonds

- Bonds

- Sale of assets

- Equity Offering

A market in which there is increased stock trading and rising stock prices

- Bull Market

What is a large pool of money that several people put together, and that is usually invested in stocks and bonds and managed by a financial expert?

- Mutual fund

- Stock

- Bond

- Bitcoin

Which of the following refers to Real Return?

- Bond coupon sum that is paid annually

- Dividend return as announced by the company

- Net return after taking into account inflation rate

- Properties' rental level increments over time

What is the role of a custodian in investments?

- Safeguarding and administering financial assets on behalf of clients, ensuring compliance with regulatory and legal requirements

- Providing investment advice to clients

- Executing trades on behalf of clients

- Ensuring tax exemptions on investments

When you have money to invest and you are concerned with how much *extra* money you can earn, with which concept are you concerned?

- Return

- Risk

What are the full forms of RD and FD

- Recurring deposit , fixed deposit

- Ruler deposit, funding deposit

- reccuring deposit, fraction deposit

- none of these

Inflation is usually associated with (can be more than 1 right answer)

- Higher purchase prices of goods and services

- Higher purchase prices of goods and services

- Higher demand of goods and services compared to supply of goods

- Reduced investment returns

What does REIT stand for?

- Realty Expense Investment Treaty

- Real Estate Interest Trust

- Restriction Environment Investment Trust

- Real Estate Investment Trust

A security in which the investor loans money to a company or government, which then pays regular interest to the bondholder and returns the principal on the bond's maturity date

- Bond

An account that lets individual investors trade stocks, bonds, mutual funds, and other investments

- Brokerage Account

The rate at which the price of goods increases and consumer purchasing power decreases over time

- Inflation

A sum of money paid to shareholders of a corporation out of its earnings.

- index

- dividend

- profit

- invest

The second largest stock exchange in the world behind the NYSE.

- NASDAQ

Most people prefer to pay health insurance premiums rather than pay out-of-pocket for medical expenses because

- medical costs can be extremely high, and insurance is more affordable than paying out-of-pocket for a hospital stay.

What is the meaning of a "market order" in investing?

- An order to buy or sell a security immediately at the best available price

- An order to buy or sell a security at a specific future date

- An order to buy or sell a security at a specific price or better

- An order to buy or sell a security after market hours

A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including mutual funds and ETFs

- Portfolio

On January 1, 2009, Tree Company borrowed P5,000,000 from a bank at a variable rate of interest for 4 years. Interest will be paid annually to the bank on December 31, and the principal was due on December 31, 2012. Under the agreement, the market rate of interest every January 1 resets the variable rate for that period and the amount of interest to be paid on December 31. In conjunction with the loan, Tree Company entered into a "receive a variable, pay fixed" interest rate swap agreement with another bank speculator.The interest rate swap agreement was designated as a cash flow hedge. The market rates of interest are:January 1, 2009 10%January 1, 2010 14%January 1, 2011 12%January 1, 2012 11%The present value of an ordinary annuity of 1 is as follows:At 14% for three periods 2.32At 12% for two periods 1.69At 11% for one period 0.90What is the derivative asset or liability on December 31, 2009?

- 464,000 asset

- 464,000 liability

- 600,000 asset

- 600,000 liability

What does owning stock give you?

- [No Answer]

On January 1, 2009, Bell Company paidP18,000,000 for 50,000 ordinary shares of Base Company which representa 25% interest in the net assets of Base. The acquisition cost is equalto the book value of the net assets acquired. Bell has the ability toexercise significant influence over Base. Bell received a dividend ofP35 per share from Base in 2009. Base reported net income of P9,600,000for the year ended December 31, 2009. In its December 31, 2009 balancesheet, Bell should report the investment in Base Company at:

- 18,000,000

- 18,650,000

- 20,400,000

- 22,150,000

The type of investment account that helps people store their money for easy access if needed is known as a...

- Certificate of Deposit

- Savings account

- Retirement account

- Mutual fund

What is IPO

- Initial Public offering

- Independent public offering

- Introductory public offering

- Initial private order

Dividends is____________

- part of a firm’s profit that is divided amongst shareholders

- part of personal profit to share with family

- Interest on savings

- bonus money from employer

Derivatives are traditionally used for (you may choose more than one answer)

- hedging against commodity price movements at pre-determined point in future

- hedging against commodity price movements at pre-determined point in future

- minimize risk of paying higher prices for an asset at one point in future

- fixing an agreed price today for a transaction taking place in the future

- commodities such as gold, silver, soybean, palm oil etc.

On January 1, 2009, Den Company purchased ten-year bonds with a face value of P1,000,000 and a stated interest rate of 8% per year, payable semiannually on July 1 and January 1. The bonds were acquired to yield 10%. Present value factors are as follows:Present value of 1 for 10 periods at 10% .386Present value of 1 for 20 periods at 5% .377Present value of an annuity of 1 for 10 periods at 10% 6.145Present value of an annuity of 1 for 20 periods at 5% 12.462The purchase price of the bonds is:

- 875,380

- 1,000,000

- 1,100,000

- 1,124,620

The second largest stock exchange in the world behind the NYSE

- Nasdaq

Which best describes what a market index does?

- An index measures market performance.

The technique of buying a fixed dollar amount of a particular investment on a regular schedule, regardless of its price. More shares are purchased when prices are low, and fewer shares are bought when prices are high.

- Dollar-Cost Average

What is the significance of a "lock-up period" in investing?

- The time it takes for an investment to reach its full potential

- A period during which early investors and company insiders are restricted from selling their shares after an IPO

- The time it takes for a mutual fund to mature

- The time it takes for an investment to generate a return

Taxes are often owed on

- investment returns.

An employer contribution made to their employees' 401(k) plan based on individual employee's contributions. An employee must contribute to the plan in order to receive a match from his/her employer.

- 401(k) Match

The overall collection of investments held by a person.

- Fund

- Portfolio

- Savings Account

- Certificate of Deposit

An example of what is a savings account is...

- money market accounts

- stocks

- bonds

- none

A market where shares in corporations are bought and sold through an organized system

- Stock Exchange

What is the meaning of "capital preservation" in investing?

- A primary investment objective to protect the initial investment amount or capital from loss

- A strategy to maximize returns on investments

- An investment approach focused on diversification

- An investment approach focused on aggressive growth

What type of stock pays dividends and consistently?

- Income Stocks

Which statement is true of the relationship between risk and return?

- The greater the risk, the greater the potential return.

Semiannually means

- Once a year

- Every other year

- Twice a year

- Four times a year

What is the meaning of a "bear market" in investing?

- A market characterized by rising prices and investor optimism

- A market characterized by falling prices and investor pessimism

- A market with stable prices and low volatility

- A market with no trading activity

The increase in the general price of goods and services in an economy over a period of time.

- Inflation

On January 1, 2009, Weller Companypurchased 10% of Pea Company's outstanding ordinary shares forP4,000,000. Weller is the largest single shareholder in Pea andWeller's officers are a majority of Pea's board of directors. Peareported net income of P5,000,000 for 2009 and paid dividends ofP1,500,000. In its December 31, 2009 balance sheet, what amount shouldWeller report as investment in Pea?

- 3,850,000

- 4,000,000

- 4,350,000

- 4,500,000

An online wealth management service that provides automated, algorithm-based portfolio management advice without the use of human financial planners

- Robo-Advisor

What does 're-basing an index' means?

- Move the index's base year to another year

- Start the index base below 100 points

- Create different base year for each asset tracked

- Place real estate at higher base than other assets

What is the meaning of a "stop-loss order" in investing?

- An order to buy or sell a security immediately at the best available price

- An order to buy or sell a security at a specific future date

- An order to sell a security when its price falls to a certain level to limit losses

- An order to buy or sell a security at a specific price or better

One's approach to markets based on a set of principles, beliefs, or experiences that drive trading and portfolio decisions.

- Investment Philosopy

- Trading Disposition

- Fundamental Decision-making

_________ policy involves government changes to spending or taxation to affect the economy.

- Fiscal

An asset is __________

- liability

- items of value

Why does insurance often provide "peace of mind"?

- People are less worried when they know they have protection from risk.

A financial asset, such as a stock or a bond, that can be bought and sold in a financial market

- Security

A retirement savings plan, sponsored through your employer who will often match your contributions, that allows an individual to save for retirement and have the savings grow while deferring taxes until funds are withdrawn

- Traditional 401(k) Plan

Capital appreciation refers to

- the increased value of an asset.

What is the role of a transfer agent in investments?

- Managing investments on behalf of clients

- Maintaining records of a company's shares and shareholders, as well as handling the issuance and transfer of shares

- Providing investment advice to clients

- Ensuring tax exemptions on investments

What is the role of a financial advisor in investments?

- Guaranteeing profits on investments

- Providing guidance and advice on investments

- Handling the actual investments of clients

- Ensuring tax exemptions on investments

Bonds are considered to offer a guaranteed return, as they must be honored by law, but which is still a potential risk that investors face?

- The issuer could go bankrupt.

Which characteristic is most important in determining an investment's level of risk?

- increased interest ratesdecreased borrowingdecreased investing

Business may invest___________

- in machinery

- technology

- products

- all the above

On January 1, 2009, Cameron Company purchased bonds with the face value of P5,000,000 at the cost of P4,700,000. The stated interest is 10% payable annually every December 31. The bonds mature in 4 years or January 1, 2011.How much interest income should be reported by Cameron Company for the year ended December 31, 2009, using the effective interest method?

- 470,000

- 500,000

- 517,000

- 562,590

On April 1, 2009, Sailor Companypurchased P2,000,000 face value, 9%, Treasury Notes for P1,985,000,including accrued interest of P45,000. The notes mature on July 1,2010, and pay interest semiannually on January 1 and July 1. Sailoruses the straight-line method of amortization. In its October 31, 2009balance sheet, the carrying amount of this investment should be:

- 1,940,000

- 1,968,000

- 1,972,000

- 1,990,000

What is the role of the SEC (U.S. Securities and Exchange Commission) in investing?

- Regulating the securities industry, enforcing securities laws, and ensuring fair and transparent markets for investors and companies

- Regulating international investments

- Providing investment advice to the public

- Ensuring tax exemptions on investments

The first time a company issues stock that may be bought by the general public.

- Initial Public Offering (IPO)

Reinvesting earned interest back into the principal to allow money to grow exponentially over time

- Compound Interest

FD is called a Term deposit

- True

- False

What is a REIT (Real Estate Investment Trust)?

- A company that owns, operates, or finances real estate that produces income, often through leasing or renting, and can be publicly traded

- An ownership share in a real estate property

- An investment in international markets

- A low-risk individual stock investment

What does the term "volatility" mean in investing?

- The degree of variation of a financial instrument's price over time

- The interest earned on an investment

- The total value of an investment portfolio

- The ability to quickly convert an investment into cash

What does the term "blue chip" refer to in the context of stocks?

- A well-established, financially stable company with a long history of reliable performance

- A start-up company with high growth potential

- A company with volatile stock prices

- A small-cap stock

Justin wants to go to spend a month traveling Europe next summer but doesn’t have the money to do so. He’s thinking of investing the $700 he currently has saved in stock in his favorite restaurant in hopes of earning the money for the vacation. Why shouldn’t he do that?

- Investing in one company’s stock is quite risky.

- Investing your whole savings in the stock market is a bad financial move.

- One year probably isn’t enough time for one stock to turn $700 into a month’s vacation.

- All of the above

What is a portfolio in the context of investing?

- A collection of investments owned by an individual or organization, which may include stocks, bonds, real estate, and other asset types

- A government-issued investment bond

- An ownership share in a company

- A low-risk investment option

On January 1, 2009, Tree Company borrowed P5,000,000 from a bank at a variable rate of interest for 4 years. Interest will be paid annually to the bank on December 31, and the principal was due on December 31, 2012. Under the agreement, the market rate of interest every January 1 resets the variable rate for that period and the amount of interest to be paid on December 31. In conjunction with the loan, Tree Company entered into a "receive a variable, pay fixed" interest rate swap agreement with another bank speculator.The interest rate swap agreement was designated as a cash flow hedge. The market rates of interest are:January 1, 2009 10%January 1, 2010 14%January 1, 2011 12%January 1, 2012 11%The present value of an ordinary annuity of 1 is as follows:At 14% for three periods 2.32At 12% for two periods 1.69At 11% for one period 0.90What is the derivative asset or liability on December 31, 2010?

- 200,000 asset

- 200,000 liability

- 169,000 asset

- 169,000 liability

What is the meaning of a "bullish investor" in investing?

- A risk-averse investor

- A risk-seeking investor

- An investor who believes in a positive market outlook and expects prices to rise

- An investor who believes in a negative market outlook and expects prices to fall

What is stock market ?

- Non-Fungible token

- Trading of shares of privately listed companies

- Trading of shares of public listed companies

- none of these

Which questions should Robert ask himself before investing the $10,000 he inherited? Check all that apply.

- How am I protected as an investor? What guarantees are in place so I make money? What taxes will I have to pay on this investment?How do the risks compare to the potential gains? What are the chances that the investment will fail?

Which of the following is the LEAST risky investment?

- corporate bonds

- stocks

- U.S. Treasury bonds

- mutual funds

What is similar about savings accounts and investments?

- [No Answer]

What is the meaning of ROI in the context of investments?

- Rate of Interest

- Return on Investment

- Risk of Investment

- None of the above

What is an annuity in the context of investments?

- A financial product that provides a series of payments made at equal intervals

- A type of government bond

- An investment in foreign currencies

- A low-risk investment option

Congo Grill operates a chain of seafood restaurants. On January 1, 2009, Congo Grill determined that it would need to purchase 100,000 kilos of tuna fish on January 1 2010. Because of the volatile fluctuation in the price of tuna fish, on January 1, 2009, Congo negotiated a forward contract with a reputable financial institution for Congo Grill to purchase 100,000 kilos of tuna fish on January 1, 2010, at a price of P8,000,000 of P80 per kilo. This forward contract was designated as a cash flow hedge.On December 31, 2009, and January 1, 2010, the market price of tuna fish per kilo is P75. The appropriate discount rate is 6%, and the present value of 1 at 6% for one period is .943. Congo Grill uses the perpetual system.Congo Grill shall recognize a derivative liability on December 31, 2007, at:

- 0

- 250,000

- 471,500

- 500,000

Money from the profits of a company that is paid out to its shareholders, typically on a quarterly basis

- Dividend

A mutual fund is a pool of money managed by a professional _____

- Banker

- Bank teller

- Accountant

- Fund manager

As an investor, if you wanted to diversify your retirement portfolio, which financial product should you select?

- Stock

- Mutual fund

- Bond

- Bitcoin

The Federal Insurance Contributions Act (FICA) is the federal law that requires an employer to withhold three separate taxes from the wages they pay their employees: a 6.2 percent Social Security tax;a 1.45 percent Medicare tax and beginning in 2013, a 0.9 percent Medicare surtax when the employee earns over $200,000.

- FICA

What is the meaning of "compounding" in investment?

- Earning returns not only on the initial investment but also on the accumulated returns over time

- Investing in a mix of assets

- Investing in high-risk ventures

- Investing in foreign currencies

Which best describes the role that government and business play in investments?

- NOT They both invest money to earn a profit.

Stocks of a company fall if performance is good

- True

- False

- May or may not

A collection of stocks and/or bonds that are traded on securities exchanges. Unlike mutual funds, they can be traded throughout the day like an individual stock.

- Exchange-Traded Fund (ETF)

Why did the tech startup 'Techie Corp.' issue stocks?

- To create an investment opportunity into other businesses.

- To increase employee cooperation

- To be traded individually

- To raise money for their new AI project

When you lay money out and hope to make a profit it is known as:

- Investment

What is the meaning of a "market correction" in investing?

- A significant decline in the overall market or a specific asset, typically around 10% or more from its recent peak

- A significant increase in the overall market or a specific asset

- A change in government policies affecting the market

- A change in interest rates affecting the market

In what circumstance would a property insurance claim be rejected?

- The insurance company finds that a homeowner intentionally caused damage

What is a characteristic of Closed-End funds?

- They have as many shares as managers want to create

- They are NOT sold to investors in the market

- They have a fixed number of shares

- You need an investment of $250,000 or more to have access to the fund

Seed Company bought 40% of Adam Company'soutstanding ordinary shares on January 1, 2009, for P4,000,000. Thecarrying amount of Adam's net assets at the purchase date totaledP9,000,000. Fair values and carrying amounts were the same for allitems except for plant and inventory, for which fair values exceededtheir carrying amounts by P900,000 and P100,000, respectively. Theplant has an 18-year life. All inventory was sold during 2009. During2009, Adam reported net income of P1,200,000 and paid a P200,000 cashdividend. What amount should Seed report in its income statement fromits investment in Adam for the year ended December 31, 2009?

- 320,000

- 360,000

- 420,000

- 480,000

A financial asset—such as a stock or a bond—that can be bought and sold in a financial market.

- Security

What does the term "tax-advantaged account" mean in investing?

- A type of government bond

- An account offering tax benefits for saving or investing, such as a 401(k) or IRA

- An account with high fees and taxes

- An account with no investment restrictions

What is risk tolerance in investing?

- The willingness to take on high-risk investments

- An investor's ability and willingness to endure fluctuations in the value of their investments

- Investing in government-issued bonds

- Investing in blue-chip stocks

Which bond protects you from inflation?

- EE Bonds

- I Bonds

The annual interest payment on a bond, usually expressed as a percentage of its face value

- Coupon

What is superannuation?

- Interest received from your saving from the property you have bought

- is a compulsory savings account where each time you are paid over a certainamount, your employer will allocate a percentage of your income to the account.

A couple has decided to increase their income from investments for when they retire in twenty years. Which is the best way they can accomplish that goal?

- by enrolling in a 401k and investing in the stock market

A total of $6000 is invested in two accounts. The interest rate on one account is 9%; on the second account, the interest rate is 6%. How much should be invested in each account so both accounts earn the same annual interest?

- 4%

- 6%

- 7%

- 8%

On January 1, 2009, Ken Company purchased30% interest in Barbie Company for P2,500,000. On this date Barbie'sshareholders' equity was P5,000,000. The carrying amounts of Barbie'sidentifiable net assets approximated their fair values, except for landwhose fair value exceeded its carrying amount by P2,000,000. Barbiereported net income of P1,000,000 for 2009 and paid no dividends. Kenaccounts for this investment using the equity method. In its December31, 2009 balance sheet, what amount should Ken report as investment inassociate?

- 2,100,000

- 2,200,000

- 2,760,000

- 2,800,000

What is one way in which bonds do not generate income for investors?

- Bonds pay a specified amount at maturity.

If an investor has a $5,000 pretax return, the state tax rate is 4.5%, and the federal tax rate is 22.0%, what is the real investment value?

- $3,675

What is a growth stock in investing?

- A stock with very low volatility

- A stock with consistently high dividends

- An ownership share in a company

- A stock expected to have substantial growth in earnings and revenue

On January 1, 2009, Fork Companypurchased 50,000 ordinary shares of Ovaltine Company for P3,600,000. OnDecember 31, 2009, Fork received 50,000 stock rights from Ovaltine.Each right entitles the holder to acquire on share for P85. The marketprice of Ovaltine's share was P100 immediately before the rights wereissued, and P90 a share immediately after the rights were issued. Forksold its rights on December 31, 2009 for P10 a right. Fork's gain fromthe sale of the rights is:

- 0

- 100,000

- 140,000

- 500,000

If a company pays dividends on a stock, does that mean that the stock has appreciated in value? Why or why not?

- No, the payment of dividends indicates that a company has earned profits.

Which is better

- RD

- FD

- NFT

Money from the profits of a company that is paid out to its shareholders (typically, on a quarterly basis).

- Dividend

Complete the statement: "The riskier the investment, the ________________ the return."

- larger

Which of these are considered both short- and long-term investments? Check all that apply.

- mutual fundsbondscommodities

Which investment has the least liquidity?

- 401k

Sushi Company owns 30,000 ordinary shares of Sashimi Company acquired on July 31, 2009, at a total cost of P1,100,000. On December 1, 2009, Sushi received 30,000 stock rights from Sashimi. Each right entitles the holder to acquire one share at P45. The market price of Sashimi's share on this date, ex-right, was P50 and the market price of each right was P5. Sushi sold its rights the same date at P5 a right less a P10,000 commission. The gain from the sale of the rights should be reported by Sushi at:

- 40,000

- 50,000

- 140,000

- 150,000

Which is a commodity someone might invest in?

- natural resources

Interest rates are expressed as a percentage of

- the loan.

The world's largest stock exchange, physically located in New York City

- New York Stock Exchange (NYSE)

Why is compound interest more advantageous than simple interest when saving for retirement?

- It’s more difficult to calculate, so fewer people use compound interest when saving for retirement.

- Compound interest accumulates very rapidly when saving for retirement, so you only have to save for 3 years or fewer to earn far more money.

- Compound interest is taxed more.

- In compound interest, you earn interest on not only your principal, but also on the interest you’ve already made when saving for retirement.

Mac Company made investment for 5 years at 12% per annum compounded semiannually to equal P7,160,000 on the date of maturity. What amount must be deposited now at the compound interest to provide the desired sum? Round off future value factor to two decimal places.

- 3,768,420

- 4,000,000

- 4,068,180

- 4,236,680

The practice of investing in a large variety of stocks, bonds, and/or funds as a way to as a way to reduce your overall risk

- Diversification

On October 1, 2008, Pentel Company purchased 6,000 of the P1,000 face value, 10% bonds of Ophra Company for P6,600,000 including accrued interest of P150,000. The bonds, which mature on January 1, 2015, pay interest semiannually on January 1 and July 1. Pentel used the straight-line method of amortization and appropriately recorded the bonds as long-term investments. On Pentel's December 31, 2009 balance sheet, the bonds should be reported at:

- 6,450,000

- 6,432,000

- 6,426,000

- 6,360,000

Which type of investment is the least risky?

- stock

- bond

- mutual fund

- savings account

A market in which prices are falling, encouraging selling.

- Bear Market

A type of investment fund that rebalances its asset mix over time based on a projected retirement year

- Target Date Fund (TDF)

Dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash

- Asset Allocation

What is the meaning of a "bull market" in investing?

- A market characterized by rising prices and investor optimism

- A market characterized by falling prices and investor pessimism

- A market with stable prices and low volatility

- A market with no trading activity

Which is always a cost when buying insurance?

- premium

Which of the following types of investment accounts are considered "low return"?

- Stocks

- Certificate of Deposit

- Mutual fund

- Retirement account

- Savings account

An individual retirement account that allows a person to set aside pre-tax income up to a specified amount each year

- Traditional IRA

Please draw the equation to calculate 10% of $100.

- [No Answer]

Which of the following statements are true?

- Between cash, stocks, and bonds, bonds are typically considered the riskiest.

- Stocks are the riskiest investments out there.

- Putting money into a savings account with interest is the ideal way for a young adult to invest.

- Historically, stocks have had far greater annual returns than cash, government bonds, and savings

When you purchase shares of Apple Inc., you are buying a small piece of _______ in the company.

- debt

- ownership

- risk

Interest earned on both the principal amount and any interest already earned.

- Compound Interest

On July 1, 2009, Hillary Company purchased Esau Company's ten-year 12% bonds as a long-term investment, with a face value of P5,000,000 for P4,760,000. Interest is payable semiannually on January 1 and July 1. The bonds matured on July 1, 2013. Hillary uses the straight-line method of amortization. What amount of interest income should Hillary report in its income statement for the year ended December 31, 2009?

- 270,000

- 300,000

- 330,000

- 360,000

What is a stock?

- A type of government bond

- A certificate of ownership in a company

- An investment representing ownership in a company

- A low-risk investment option

If the Federal Reserve decreased the money supply, what would the effects be? Check all that apply.

- -increased interest rates-decreased borrowing-decreased investing

Degree of uncertainty on how likely the investor is to make money on an investment.

- Risk

What is dollar-cost averaging in investing?

- Investing a fixed amount of money at regular intervals, regardless of market conditions

- Investing only in the US stock market

- Investing in government-issued bonds

- Investing in high-yield stocks

A tax levied on profit from the sale of property or an investment

- Capital Gains Tax

What is the significance of "book value" in investing?

- The initial offering price of a stock

- The total value of a company's assets

- The value of a company's assets minus its liabilities, often used as a measure of a company's intrinsic value

- The interest earned on an investment

The graph shows examples of investments with high and low liquidity.An investment with more liquidity would be ideal for someone who

- knows they will need cash in the near future.

Profit from the sale of an asset, such as a stock or a bond, calculated by subtracting the price you initially paid from the price you then sold it for

- Capital Gain

A group of financial instruments which have similar financial characteristics and behave similarly in the marketplace (like stocks, bonds, and cash)

- Asset Class

If the nominal interest rate is 4.00% and the rate of inflation is 2.25%, what is the real interest rate?

- 1.75%

Interest rates generally reflect

- the level of risk in an investment

On January 1, 2008, Tough Companyacquired 10% of Complex Company's ordinary shares outstanding forP6,000,000. Tough appropriately accounts for this investment by thecost method. Complex Company reported the following for the years endedDecember 31, 2008 and 2007: NET INCOME CASH DIVIDEND2008 400,000 02009 1,200,000 1,800,000In its income statement for the year ended December 31, 2009, Easy Company should report dividend income at:

- 0

- 120,000

- 160,000

- 180,000

On January 1, 2009, Tree Company borrowed P5,000,000 from a bank at a variable rate of interest for 4 years. Interest will be paid annually to the bank on December 31, and the principal was due on December 31, 2012. Under the agreement, the market rate of interest every January 1 resets the variable rate for that period and the amount of interest to be paid on December 31. In conjunction with the loan, Tree Company entered into a "receive a variable, pay fixed" interest rate swap agreement with another bank speculator.The interest rate swap agreement was designated as a cash flow hedge. The market rates of interest are:January 1, 2009 10%January 1, 2010 14%January 1, 2011 12%January 1, 2012 11%The present value of an ordinary annuity of 1 is as follows:At 14% for three periods 2.32At 12% for two periods 1.69At 11% for one period 0.90What is the derivative asset or liability on December 31, 2011?

- 45,000 asset

- 45,000 liability

- 50,000 asset

- 50,000 liability

Bitcoin is an example

- money

- share

- cryptocurrency

- debenture

An individual retirement account that allows a person to set aside after-tax income up to a specified amount each year

- Roth IRA

Which investor is making a common error?

- an employee of a popular hardware store who invests only in that company's stock

Which statements are true regarding an individual retirement account? Check all that apply.

- People can contribute to the account until retirement age. Contributions to the account are limited each year. Contributions can be deducted from federal taxes.

The graph shows the effect of inflation.Approximately how much of the initial investment's value would be lost after 15 years at 3% inflation?

- 40%

Putting money into more than one kind of investment at a time is called

- diversification.

On January, 1 2008, Wayne Company bought15% of Parrot Company's ordinary shares outstanding for P6,000,000.Wayne appropriately accounts for this investment by the cost method.The following data concerning Parrot are available for the years endedDecember 31, 2008 and 2009: 2008 2009Net income 3,000,000 9,000,000Cash dividend paid None 10,000,000In its income statement for the year ended December 31, 2009, how much should Wayne report as income from this investment?

- 450,000

- 1,350,000

- 1,500,000

- 1,800,000

What is the meaning of "liquidity risk" in investing?

- The rate at which the general level of prices for goods and services is rising

- The rate at which an investment can be sold or converted into cash without loss of value

- The risk associated with fluctuations in the value of investments

- The risk of being unable to sell an investment quickly at a fair price

What kind of stock gives you money but no vote?

- common

- preferred

On January 1, 2009, Dryer Companyacquired as a long-term investment a 20% ordinary share interest inEpson Company. Dryer paid P7,000,000 for this investment when the fairvalue of Epson's net assets was P35,000,000. Dryer can exercisesignificant influence over Epson's operating and financial policies.For the year ended December 31, 2009, Epson reported net income ofP4,000,000 and declared and paid cash dividends of P1,600,000. How muchrevenue from this investment should Dryer report for 2009?

- 320,000

- 480,000

- 800,000

- 1,120,000

What is the primary goal of investing?

- Generate maximum returns

- Preserve capital

- Both A and B

- Diversify assets

What is Mutual fund?

- An investment in which investors pool their money to buy stock.

- An investment that you put in your checking account

- Investment that you put in your swimming pool.

- Investment that you put in the ground.

What is an example of an investment?

- savings

- stocks

- cash

- none

What is a trustee in investing?

- A person or entity appointed to manage assets held in a trust on behalf of beneficiaries

- An individual investing in government-issued bonds

- An individual investing in international markets

- An individual with a low-risk investment portfolio

Ali wants to borrow some money. What does interest rate mean to her?

- The fixed amount of money that Ali agrees to pay back as well as the principal.

- The principal amount of the loan that Ali is asking to borrow.

- Interest means paying back on your credit card every month.

- Interest means not being late on paying back on your credit card.

A collection of stocks and/or bonds, typically chosen and actively managed by an "expert" in exchange for a fee from each investor.

- Mutual Fund

What is the concept of "buy and hold" in investing?

- A long-term investment strategy where an investor buys and holds onto an investment for an extended period, regardless of market fluctuations

- A short-term investment strategy focused on quick gains

- A medium-term investment strategy with regular buying and selling

- An investment strategy based on market speculation

On January 1, 2009, Kent Companypurchased 20% of Luther Company's ordinary shares outstanding forP6,000,000. During 2009, Luther reported net income of P7,000,000 andpaid cash dividend of P4,000,000. The balance in Kent's investment inLuther Company account at December 31, 2009 should be:

- 5,200,000

- 6,000,000

- 6,600,000

- 7,400,000

Spreading your money into a variety of asset classes, with multiple investments or indexes in each asset class, so that your investment is not reliant on the success of one company. Diversifying minimizes risk.

- Diversification

Which of the following types of investments accounts are considered "higher risk"?

- Retirement account

- Mutual funds

- Certificate of Deposit

- Savings account

- Stocks

Where do you buy and sell shares from?

- Share market

You wish to purchase an apartment in one year's time. The price today is £200,000 and you expect inflation rate at 3% per annum. What is the apartment's price in one year's time?

- £203,000

- £206,000

- £230,000

- £200,600

A collection of stocks and/or bonds combined into one fund which will be traded as a unit, typically chosen and actively managed by an "expert" in exchange for a fee from each investor

- Mutual Fund

Crane Company purchased a P1,000,000 life insurance policy on its president, of which Crane is the beneficiary. Information regarding the policy for the year ended December 31, 2009, follows:Cash surrender value, 1/1 87,000Cash surrender value, 12/31 108,000Annual advance premium paid 1/1 40,000During 2009, the dividend of P6,000 was applied to increase the cash surrender value of the policy. What amount should Crane report as a life insurance expense for 2009?

- 13,000

- 19,000

- 25,000

- 40,000

An individual retirement account that allows a person to set aside after-tax income up to a specified amount each year. Both earnings on the account and withdrawals after age 59½ are tax-free.

- Roth IRA

What is a 529 plan?

- A tax-advantaged savings plan designed to encourage saving for future education costs

- A government-issued investment bond