Ctrl + F is the shortcut in your browser or operating system that allows you to find words or questions quickly.

Ctrl + Tab to move to the next tab to the right and Ctrl + Shift + Tab to move to the next tab to the left.

On a phone or tablet, tap the menu icon in the upper-right corner of the window; Select "Find in Page" to search a question.

Share UsSharing is Caring

It's the biggest motivation to help us to make the site better by sharing this to your friends or classmates.

Accounting

Involves recording, analyzing, and interpreting financial information to inform decision-making, financial planning, and control within organizations.

assets

liabilities

equity

revenue

expenses

income

cash

accounts receivable

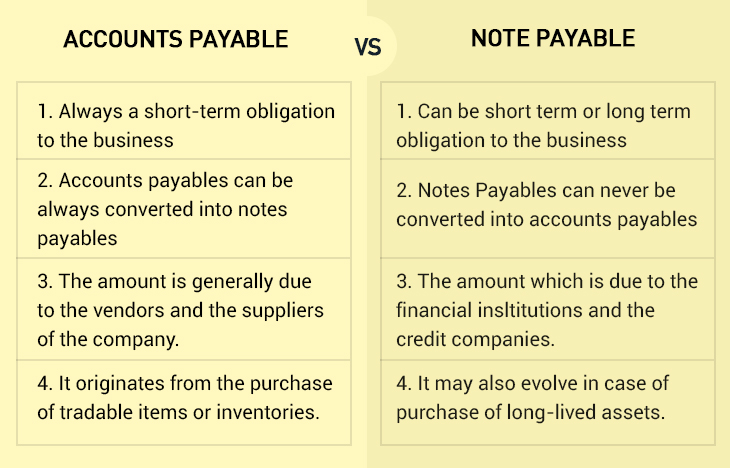

accounts payable

balance sheet

income statement

financial statements

audit

taxation

depreciation

budgeting

Determine the net effect of the transaction by keying in i = increased, d = decreased, n = no effect.Withdrew monies for personal use: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example i n i (This means Assets increased, Liabilities have no effect, and Owner's Equity increased.If Assets increased and decreased and Liabilities have no effect and Owner's Equity has no effect, the answer should be id n n).

- d n d

Match the following

- Income Statement

- Expense Account

- Balance Sheet

- Liabilities

- Owner's Equity

- Capital

- Assets

- Revenue

Use the following information below to answer questions 31 – 32 Opening stock ₦40,000Purchases ₦130,000Closing stock ₦32,000Sales ₦180,000What is the cost of goods sold?

- a) ₦170,000

- b) ₦138,000

- c) ₦122,000

- ₦123,000

The following assets can be revalued except

- building

- goodwill

- furniture

- fittings

The assets of a business can be classified broadly into

- a) fixed and floating assets

- b) fixed and current assets

- c) intangible and fixed assets

- d) current and circulating assets

The following are balance sheet items except

- Closing stock

- Opening stock

- Net profit

- Prepayment

Capital, drawings, and net income will affect [Blank]____. (State whether these affect Assets, Liabilities, or Owner's Equity).

- Owner's Equity

Place the following in the order that they show up on a Balance sheet, starting with the left column then moving to the right column.

- Current Assets

- Equipment

- Current Liabilities

- Long Term Liabilities

- Owner's Equity

Which one do you like? Sales returns can also be referred to as …………..

- a) total sales

- b) returns inwards

- c) total returns

- d) returns outwards

Define the term Owner's Equity

- [No Answer]

Depreciation of asset is provided for in consideration of ------ .

- disposal

- loss of fire

- lost in transit

- wear and tear

Determine the net effect of the transaction by keying in i = increased, d = decreased, n = no effect.Sold away motor vehicle on credit: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example, i n i (This means Assets increased, Liabilities have no effect, and Owner's Equity increased.If Assets increased and decreased and Liabilities have no effect and Owner's Equity has no effect, the answer should be id n n).

- id n n

- id n n

- di n n

The account known as principal book of account is …………

- a) trial balance

- b) cash book

- c) ledger

- d) balance sheet

Owner contributed $7,500 cash and $15,000 vehicle to the business.

- Cash increased by $7,500, Vehicle increased by $15,000 & Capital increased by $22,500

- Cash increased by $7,500 & Capital increased by $7,500

- Cash increased by $7,500, Vehicle increased by $15,000 & Capital increased by $7,500

- Cash increased by $7,500, Vehicle increased by $15,000 & Capital decreased by $22,500

What is the value of the opening capital? Image: file:///C:/Users/acer/AppData/Local/Temp/msohtmlclip1/01/clip_image001.gif

- N1,500.00

- N1,000.00

- N2,800.00

- N2,000.00

The manager of the business wrote on a piece of paper that utility expenses incurred by the business were paid the amount of P2,222. The bookkeeper asked for the invoice evidencing the payment before recording it in journal.

- Objectivity

- Materiality

- Money Measurement

- Going Concern

Bookkeeping is a detail-oriented career that requires knowledge and skills to do the job correctly.

- Competence

- Integrity

- Independence

- Objectivity

A written policy document issued by expert accounting body or body of government or regulatory body covering the aspects of recognition, treatment, measurement, presentation and disclosure of accounting.

- Rule of Conduct

- Accounting Standard

- Accounting Ethics

- Accounting Guidelines

Profit or loss account is prepared after the …..

- a) cash book

- b) ledger

- c) trading account

- d) ledger

C.K. Enterprise has fittings $4,000, inventory $5,000, debtors $2,750, bank overdraft $3,450 and creditors $1,250. Calculate the amount of owner's equity in the business.

- 7,500

- 13,500

- 7,050

- 16,450

How would an accountant record an increase in cash?

- Debit

- Credit

Purchases journal is used to record goods bought on ………..

- a) repairs

- b) credit

- c) owners use

- c) eating

The left side of a T-Account is called

- Debit

- Credit

- Left Side

- Right Side

What is the total value of Agboola's fixed assets?

- N2,800.00

- N1,500.00

- N1,300.00

- N500.00

……… is a written acknowledgement that a person received money or property in payment following a sale or other transfer of goods or provision of service?

- Cheque Stub

- Airfreight Note

- Receipt

- Paper Money

Purchases worth ₦7,000 for the period

- a) single side

- b) debit side

- c) credit side

- d) folio column

Business transactions are reported in numbers that have common values—that is, using a common unit of measurement.

- Money Measurement

- Entity Concept

- Revenue Recognition

- Matching Principle

The company repays the suppliers

- Assets (D)

- Liabilities (I)

- Equity (D)

An expenses is termed an "accrual" because it

- Is yet to be paid

- Is a profit or loss account item

- Must appear in the balance sheet

- Is a trading account item

………an exchange of intentions between a potential buyer and a potential seller backed with a cash payment or cheque payment or promise to pay or set off payment.

- Financial Documents

- Cash Transactions

- Financial transaction

- Credit Transaction

Where fixed capital are maintained, partner's drawings are transferred to the

- Credit of Capital Account

- Debit of Capital account

- Credit of Partner’s Current account

Payment for electricity bill of ₦2,200

- a) expenses side

- b) credit side

- b) folio column

- d) debit side

- Option 5

Use the information below to answer the following question. Opening stock of raw materials 24,750Purchases of raw materials 123,640Carriage on raw materials 10,000Closing stock of raw materials 45,000Factory supervisor's salary 30,000Wages of factory workers 50,000Royalties paid 18,000Insurance of factory 62,000Work in progress 23,000Raw materials returned 12,200 The value of raw materials consumed is

- N121,440

- N113,390

- N111,190

- N101,190

Rent paid in advance appears in the balance sheet as …………..

- a) A liability

- b) An asset

- c) An accrual

- d) An advance receipt

Use the information below to answer the following question. Opening stock of raw materials 24,750Purchases of raw materials 123,640Carriage on raw materials 10,000Closing stock of raw materials 45,000Factory supervisor's salary 30,000Wages of factory workers 50,000Royalties paid 18,000Insurance of factory 62,000Work in progress 23,000Raw materials returned 12,200The prime cost is

- N199,190

- N169,190

- N151,190

- N146,190

An item that distinguished single column and double column cash book is ……………..

- a) cash column

- b) bank column

- c) date column

- d) folio column

The reduction in the value of goodwill is

- Amortization

- Appreciation

- Depletion

- Depreciation

Prepayment in the balance sheet is a ……………

- a) current asset

- b) fixed asset

- c) current liability

- d) capital

………... signifies the embodiment of all structures, platforms and process put in place for smooth running and regulation of the monetary flows n the Nigerian economy?

- The Constitution

- The Finance Act

- The Nigeria Financial System

- The Nigerian Judiciary

Determine the net effect of the transaction by keying in i = increased, d = decreased, n = no effect.Paid creditors: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example, i n i (This means Assets increased, Liabilities have no effect, and Owner's Equity increased.If Assets increased and decreased and Liabilities have no effect and Owner's Equity has no effect, the answer should be id n n).

- d d n

What is assets?

- Cash in the business

- Anything that a creditor has financial claim to

- What remains after liabilities are paid

- any item or property owned by the business

A real account is the account of _________.

- Expenses or losses

- Gain or incomes

- Physical tangible assets

- Current liabilities

Using straight line method what is the depreciation to be charged annually.

- N8,750

- N12,000

- N11,600.00

- N5,800.00

Determine the net effect of the transaction by keying in i = increased, d = decreased, n = no effect.Owner contributed some furniture to the business: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example i n i (This means Assets increased, Liabilities have no effect, and Owner's Equity increased.If Assets increased and decreased and Liabilities have no effect and Owner's Equity has no effect, the answer should be id n n).

- i n i

In manufacturing account, prime cost consists of direct material, direct labour and

- Direct Wages

- Direct Overheads

- Direct Expense

- Direct Royalty

How do you find liabilities?

- Assets + Owner's Equity

- Liabilities - Assets

- Assets - Capital (Owner's Equity)

- None of the Above

What is the gross profit?

- a) ₦50,000

- b) ₦5,000

- c) ₦42,000

- d) ₦10,000

The company purchases equipment with its cash

- Assets (NE)

- Liabilities (I)

- Equity (I)

Information is based on actual costs incurred in transactions.

- Business Entity Concept

- Matching Principle

- History Cost Principle

- Full Disclosure

What is the normal Balance of Cash account?

- Debit

- Credit

What is the basic accounting equation?

- A = L + OE

If the company has $5,000 in cash and pays $3,000 in taxes, what is Owner's Equity?

- $2,000

- $15,000

- $8,000

Determine the net effect of the transaction by keying in i = increased, d = decreased, n = no effect.Received monies from debtor: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example, i n i (This means Assets increased, Liabilities have no effect, and Owner's Equity increased.If Assets increased and decreased and Liabilities have no effect and Owner's Equity has no effect, the answer should be id n n).

- id n n

- id n n

- n n n

Cash, Debtors, Land, and Equipment are examples of [Blank]___. (State whether these are Assets, Liabilities, or Owner's Equity).

- Assets

All the following are examples of source documents except?

- Cheque Stub

- Airfreight Note

- I Owe You (IOU)

- Paper Money

A list of accounts used by a business.

- accounting equation

- chart of accounts

- temporary accounts

- permanent accounts

What is the normal Balance of Utilities Expense

- Debit

- Credit

Financial statements contain all information necessary to understand a business's financial condition.

- Full Disclosure

- Periodicity

- Going Concern

- Objectivity

Set off is a ……. item in sales ledger control account.

- credit

- expenses

- debit

- minor

What must the owner's equity equal if assets equal $1,800 and liabilities equal $800?

- $2,600

- $800

- $1,000

The revenue from business activities and the expenses associated with earning that revenue are recorded in the same accounting period.

- Matching Principle

- Periodicity

- Historical Cost

- Full Disclosure

What is the normal Balance of an Equipment Account?

- Debit

- Credit

What is the normal Balance of Accounts Payable?

- Debit

- Credit

……….. are usually stated in the invoice?

- Payment Terms

- Destination of goods

- Name of shipper

- Amount paid

The total current liabilities is ____________

- N300.00

- N1,000.00

- N1,300.00

- N1,500.00

Information needed for subsidiary books preparation are extracted from ………..

- a) cash book

- b) ledger

- c) source documents

- d) journals

The Accounting Equation is

- Owner's Equity = Assets + Liabilities

- Assets = Liabilities - Owner's Equity

- Assets = Liabilities + Owner's Equity

- None of the above

When shares are issued at premium, this means that?

- The company makes loss

- The company makes gain

- The company gives out shares for nothing

- The company sell share without loss or gain

Which of the following is not a source document?

- a) invoice

- b) cheque

- c) bank teller

- d) ledger

Which accounting theory states that all transactions must be recorded at their cost at the time the transaction takes place?

- Historical cost

- Going concern

- Monetary concept

- Accounting entity

If liabilities equal $400 and owner's equity equals $800, what do the assets equal?

- $400

- $1,200

- $800

What is the net book value of the asset after 2nd year using reducing balance method?

- N41,920

- N40,320

- N25,600

- N30,720.

Who is responsible for the recording transaction of a business

- a) Liberian

- B.book keeper

- c) Manager

- d) auditor

The company purchases supplies on credit

- Assets (I)

- Liabilities (NE)

- Equity (I)

The act of collecting, recording and interpreting accounting data is ------

- cost accounting

- management accounting

- financial accounting

- data processing.

The transaction will be treated as a contra entry when ………

- a) Cash withdrew from bank for personal use

- b) Cheque received from customer and deposited

- c)Cash drew from bank for office use

- d) Cash paid to creditors

Use the information below to answer the following question. Opening stock of raw materials 24,750Purchases of raw materials 123,640Carriage on raw materials 10,000Closing stock of raw materials 45,000Factory supervisor's salary 30,000Wages of factory workers 50,000Royalties paid 18,000Insurance of factory 62,000Work in progress 23,000Raw materials returned 12,200The total overhead expenses is

- N142,000

- N115,000

- N110,000

- N92,000

Another word for start-up fund for business is ……… a

- ……… a) loan

- b) bank savings

- c) capital

- d) cash balance

Items owned by a business that has monetary value are known as:

- Liabilities

- Owner's Equity

- Assets

- All of the above

Failure to keep information confidential could open the door to fraud, identity theft, and other illegal activities if the information is shared with the wrong parties.

- Integrity Standards

- Confidentiality of Information

- Professional Skill

- Independence and Objectivity

Capital (owner's equity) is the value of the owners' investment in the business after subtracting liabilities from assets.

- True

- False

What is the depreciation charged for the 2nd year at 20% per annum using reducing balance method?

- N17,280

- N12,000

- N11,600

- N6,400

The owner invests personal cash in business.

- Asset (I)

- Liabilties (I)

- Equity (NE)

Mrs Do has personal properties of amounting to P3 million pesos. One half of this was invested in the business called Do Laundry Shop and the other half in another business called Do Convenience Store. Two financial reports were prepared by the bookkeeper, one for each business.

- Money Measurement

- Business Entity

- Going Concern

- Objectivity

Determine the net effect of the transaction by keying in i = increased, d = decreased, n = no effect.Purchased vehicle on credit: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example, i n i (This means Assets increased, Liabilities have no effect, and Owner's Equity increased.If Assets increased and decreased and Liabilities have effect and Owner's Equity has no effect, the answer should be id n n).

- i i n

The amount for which a business is sold is the

- Goodwill

- Consolidated fund

- Purchases consideration

- Capital reserved

Trade discount are given for ……….

- a) bulk purchases

- b) prompt payment

- c) quick delivery

- d) cash payment

Which of the following is equivalent to the Receipt and Payments account?

- Income and expenditure account

- Cash Book

- Subscription Account

- Profit or Loss Account

A chequecould be dishonoured due to ………….

- a) spoken English

- b) colour of print

- c) irregular signature

- d) network problem

_______ is a financial statement that reports a business's assets, liabilities, and capital on a specific date

- Balance Sheet

- Statement of Cash Flow

- Income Statement

- None of the Above

In preparing final account, a prepayment happens when ……………..

- a) payment is not made early

- b) payments made are not enough

- c) payments made have not been fully

- d) payments made have been used

Inventory is recorded at the lower of cost or net realizable value rather than the expected selling price. This ensures profit on the sale of inventory is only realized when the actual sale takes place.

- Going Concern

- Prudence Concept

- Materiality Concept

- History Cost

Which of the following is NOT an item in the profit or loss account?

- ) drawings

- b) interest

- c) salaries

- d) bad debts

Exchange of cash for goods and services is ………….

- a) bank transaction

- B) Cash Transaction

- c) credit transaction

- d) customer transaction

Payments made for services yet to be rendered is ……..

- a) post payment

- b) prepayment

- c) purchase

- d) accrual

Transfer pricing is a term used in

- Company account

- Partnership account

- Manufacturing account

- Cash account

The system of preparing a petty cash book is ………..

- a) imprest system

- B.asset system

- c) straight line system

- d) contra entry system

……. is a memorandum account for all debtors or creditors in an organization.

- Jaiz account

- Control Account

- Unity account

- Liability account

Petty cash book is ………..

- a) a statement of affairs

- b) an imprest system

- c for recording small disbursement

- d) a self balancing ledger

- Option 5

……………..are documents used to established the occurrence of a financial transaction?

- Financial Documents

- Source Documents

- Financial transaction

- Transaction Documents

Use the following to answer questions 60 - 62 NSales 35,000Purchases 20,000Closing stock 10,050Carriage outwards 650.00Carriage inwards 400.00Returns outwards 100.00Returns inwards 200.00Salaries 600.00Wages 400.00Calculate the net profit.

- N22,900.00

- N21,700.00

- N20,000.00

- N19,700.00

The Accounting Equation must always be in balance?

- True

- False

An accounting period can range between ………….

- a) April – March

- January and October

- c) June – November

- d) December – December

Goods or money taken by the owner of a business for his personal use is referred to as

- a) purchase

- b) capital

- c) sales

- d) drawings

- Option 5

The method of depreciation used above was __________.

- evaluation

- devaluation

- revaluation

- accumulation

The company repays the bank that had lent money

- Assets (I)

- Liabilities (D)

- Equity (D)

Which accounting concept gives rise to the accounting equation?

- Historical cost

- Going concern

- Monetary concept

- Accounting entity

Good sold to consumer on credit are posted in ………..

- a) principal account

- b) sales dailybook

- c) general journal

- d) cash book

Which of the following is not an accounting concept

- ) Entity

- b) Consistency

- C) Historical cost

- D) Going concern

When a transaction is completely left out, it is an error of

- Commission

- Omission

- Principle

- Compensation

The asset referred to in the above information is __________.

- current

- fixed

- fictitious

- intangible

When a new partner is admitted in to the business, apart from the capital of the business, he also brings in

- money for settlement

- Goodwill

- cost of asset

- revaluation

Jokotade returned goods to us ₦300. Which subsidiary book will this be entered?

- Return Inward Journal

- Cash Book

- Return Outward journal

- Purchases Journal

The Corona Limited Co. has three plants nationwide that cost a total of P200 million. The current fair value of the plants is P600 million. The plants will be recorded and reported as assets at:

- P200 M

- P400 M

- P600 M

- P800 M

Which of the following is a prime cost

- Royalty

- Salary

- Commission

- Discount allowed

These are broad, general statements or “rules” and “procedures” that serve as guides in the practice of accounting

- Accounting Principles

- Accounting Ethics

- General Accounting Procedures

- Professionalism

It is the art of analyzing financial transactions and economic events, recording them, classifying them into accounts, summarizing them, reporting, and interpreting the results.

- Bookkeeping

- Journalizing

- Accounting

- Auditing

Determine the net effect of the transaction by keying in i = increased, d = decreased, and n = no effect.Invested cash in a business: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example, i n i (This means Assets increased, Liabilities have no effect, and Owner's Equity increased.)

- i n i

Mr. Philip Pines is the owner of a beauty spa and wellness salon. He bought a residential house and lot which he included in the balance sheet of a beauty spa and wellness salon. This is a violation of accounting principle.

- Business Entity

- Going Concern

- Conservatism

- Objectivity

Which of the following errors will affects the totals of a trial balance?

- Compensating error

- Complete reversal of entry

- Error in addition

- Error of original entry

Paid creditor $5,000.

- Creditors increased by $5,000 & Cash decreased by $5,000

- Creditors decreased by $5,000 & Cash decreased by $5,000

- Creditors increased by $5,000 & Cash increased by $5,000

- Creditors decreased by $5,000 & Cash increased by $5,000

Creditors, Short Term Loan, and Notes Payable are examples of [Blank]___. (State whether these are Assets, Liabilities, or Owner's Equity).

- Liabilities

The word Quoted price in issue of shares means?

- The price in the prospectus

- The nominal price

- The actual price the share was sold

- The expected price the share was sold

Bought equipment worth $10,000 on credit.

- Equipment decreased by $10,000 & Debtors decreased by $10,000

- Equipment increased by $10,000 & Creditors increased by $10,000

- Equipment decreased by $10,000 & Debtors increased by $10,000

- Equipment increased by $10,000 & Bank loan increased by $10,000

List of balances in the trial balance are extracted from ………

- a) journal

- b) cash book

- c) ledger

- d) receipts

The owner withdraws cash for personal use

- Assets (D)

- Liabilities (D)

- Equity (NE)

An accounting standard can be ignored if the net impact of doing so has such a small impact on the financial statements that a reader of the financial statements would not be misled.

- Materiality

- Objectivity

- Full Disclosure

- Conservatism

A partner whose liability goes beyond his capital is known as

- Dormant partner

- Limited partner

- General partner

- Nominal partner

All the following except one are features of preference shares except?

- They have a fixed rate of dividend

- Their dividends are paid after all other classes of shares are paid

- It's dividends can be accumulated

- Preference shares can be converted to ordinary shares at a later time

The owner contributes her personal truck to the business

- Assets (NE)

- Liabilities (NE)

- Equity (D)

Subscription received in advance are

- Included in the income and expenditure account

- Not included in receipt and payment account

- Shown as a current asset in the balance sheet

- Shown in the balance sheet as current liability

Determine the net effect of the transaction by keying in i = increased, d = decreased, n = no effect.Purchased equipment for cash: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example i n i (This means Assets increased, Liabilities have no effect, and Owner's Equity increased.If Assets increased and decreased and Liabilities have no effect and Owner's Equity has no effect, the answer should be id n n).

- id n n

- id n n

- di n n

An accounting device used to analyze transactions.

- T account

- temporary account

- personal account

- permanent account

What is the normal Balance of Accumulated Depreciation?

- Debit

- Credit

The total current assets is ____________.

- N300.00

- N1,000.00

- N1,500.00

- N1,300.00

Use the following information to answer question 13 and 14 On 1/7/07, a trader owed wages of N2,000. During the year ended 30/6/08, wages of N2,400 were owed and N8,000 were paid.The wages of the year ended 30/6/08 is

- N12,400

- N8,400

- N8,000

- N7,000

Depreciation of Plant and Machinery is treated in manufacturing account as

- Direct expenses

- Overheads

- Indirect labour

- Profit and Loss item

The name given to an account

- account title

- capital

- expense

- revenue

A bookkeeper should always present the facts objectively and refrain from slanting information in a misleading way.

- Integrity Standard

- Objectivity

- Professional Competence

- Professionalism

……… ratio checks the liquidity level of the assets of the business.

- Acid Test Ratio

- Current Ratio

- Leverage ratio

- Debtor ratio

Cash book can be classified into

- a) one

- B) Two

- C) Three

- D) Four

- Option 5

- Option 6

A …………… partner only uses his names or goodwill as a contribution to the business.

- Quazi

- Nominal

- Dormant

- general

A balance sheet shows only ------

- fixed assets and current assets

- assets and current liabilities

- assets and capital

- assets and liabilities

…………. is a terminology used to describe the amount allocated to a particular item of expenditure in government budget?

- Vote

- Warrant

- Head

- Gross pay

Which account contains both real and nominal?

- a) purchases ledger

- b) debtors ledger

- c) general ledger

- d) personal ledger

Where records maintained are inadequate to facilitate the preparation of a trading, profit or loss account, this is described as

- cost accounting

- book keeping

- incomplete records

- double entry

Sales was N12,500, total expenses was N2,500 and net profit is 10% of sales. What is the gross profit?

- N11,250

- N8,750

- N3,750

- N1,250

Which of the following is not a liability

- Inventory

- Car loan

- Mortgage

- Credit card balance

Which of the following books of original entry is used to record all payments and receipts by cah and cheque?

- a) sales day book

- b) purchases day book

- c) cash book

- d) general journal

Bilis Computer Shop purchased P200 paper puncher. The useful life of paper puncher is 5 years. The bookkeeper expense the entire cost of P200 in the year it is purchased.

- Conservatism

- Matching Principle

- History Cost

- Going Concern

Which correctly shows a list of assets and liabilities?

- Assets: mortgage, car loan, land

- Liabilities: retirement savings, cash, credit card loans

- Assets: building, cash in hand, accounts receivable

- Liabilities: loans, accounts payable, mortgage

Transaction are usually affected by entries -----

- one

- double

- three

- four.

…………. is the section of the financial market that is used for buying and selling of assets which have short term life span that is financial instruments with original maturity within a year?

- Capital market

- Second Tier security Market

- Finance Market

- Money Market

The same accounting procedure must be followed in the same way in each accounting period.

- Consistency

- Materiality

- Objectivity

- Conservatism

When a buyer is under-charged, the seller forwards

- A debit note

- A credit note

- An under cast note

- A payment receipt

Taxes are an asset?

- True

- False

Items on the debit side of the cash book that are not found on the credit side of the bank statement are ……….

- a) standing order

- b) uncreditedcheques

- c) credit transfer

- d) unpresentedcheques

Cash sales worth ₦15,000

- a) credit side

- b) debit side

- c) folio column

- d) total side

What is the accumulated depreciation at the end of 3rdyear. Using straight line method?

- N17,400

- N24,000

- N26, 250

- N34,800

Cash received from Mr Crayon ₦3,000

- a) debit side

- b) credit side

- c) particular column

- d) single side

The owner took some office equipment for personal use.

- Equipment increased & Capital increased

- Equipment decreased & Capital increased

- Equipment decreased & Capital decreased

- Equipment increased & Capital decreased

Which of the following is a Trading account item

- a) discount allowed

- b) discount received

- c) carriage outwards

- d) carriage inwards

- Option 5

- Option 6

The balance in a sales ledger control account indicates:

- Difference between debtors and creditors

- Total sales

- total purchases

- Total debtors

Determine the net effect of the transaction by keying in i = increased, d = decreased, n = no effect.Repay a bank loan: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example, i n i (This means Assets increased, Liabilities have no effect, and Owner's Equity increased.If Assets increased and decreased and Liabilities have no effect and Owner's Equity has no effect, the answer should be id n n).

- d d n

The process of ascertaining the new market value of an asset is termed

- New Price

- Re-costing

- Revaluation

- Market research

Determine the net effect of the transaction by keying in i = increased, d = decreased, n = no effect.Borrowed monies from bank: Assets ___ = Liabilities ____ + Owner's Equity ____State your answer in the box in this format, for example: i n i (This means Assets increased, Liabilities have no effect and Owner's Equity increased.If Assets increased and decreased and Liabilities have no effect and Owner's Equity has no effect, the answer should be id n n).

- i i n

Money owed to an outsider is known as

- Asset

- Liability

- Owner's Equity

- Debit

The company receives cash from a bank loan

- Assets (I)

- Liabilities (D)

- Equity (D)

Turnover is another name for ……………

- a) cash book

- b) expenses

- c) sales

- d) stock

"A business unit is assumed to operate into foreseeable future and earn reasonable net income". This statement is emphasized by the concept of

- Business entity.

- Going on concern.

- Realization.

- Accrual.

Use the following to answer questions 60 - 62 NSales 35,000Purchases 20,000Closing stock 10,050Carriage outwards 650.00Carriage inwards 400.00Returns outwards 100.00Returns inwards 200.00Salaries 600.00Wages 400.00 The cost of goods sold is ____________.

- N10,650.00

- N10,250.00

- N11,850

- N12,850

All transactions recorded in the prime book are eventually posted to ……………

- a) journal

- b) trial balance

- c) ledger

- d) balance sheet

On June 25, Galing Repair Shop rendered service shop to a client for P600. The service fee was collected July 4. The bookkeeper recorded the revenue on June 25.

- Revenue Recognition

- Matching Principle

- History Cost

- Objectivity

The owner withdraws business assets for personal use.

- Assets (I)

- Liabilities (D)

- Equity (D)

GAAP stands for:

- Generally Accepted Auditing Procedures

- Generally Accepted Accounting Principles

- Generally Accepted Accounting Procedures

- Generally Auditing Accounting Principles

Amount owed by a business

- liability

- asset

- capital

- account

Use the following information to answer question 13 and 14.On 1/7/07, a trader owed wages of N2,000. During the year ended 30/6/08, wages of N2,400 were owed and N8,000 were paid.Wages recorded in the balance sheet as at 30/06/08 is

- N8,000

- N6,000

- N2,400

- N2,000

A typical journal book will not reflect

- a) date column

- b) detail column

- c) bank column

- d) total column

Which of the following books of original entry is a ledger and also a journal?

- a) Cash book

- b) Sales day book

- c) purchases day book

- d) General journal

Assets = Liabilities + Owner's EquityAssets - 100,000Liabilities- 25,000Owner's Equity- ?

- $125,000

- $25,000

- $75,000

Which of the following is not recorded in the partnership appropriation account?

- Interest on capital

- Partner’s drawing

- Share of profit

- Interest on drawing

Financial statements are prepared with the expectation that a business will remain in operation indefinitely.

- Going Concern

- Consistency

- Conservatism

- Matching Principle

What is the normal Balance of Interest Revenue?

- Debit

- Credit

The statement which shows the financial position of a business at a given point in time is …………

- a) balance sheet

- b) bank statement

- c) trial balance

- d) cash book

Assets = Liabilities + Owner's EquityAssets - 200,000Liabilities- ?Owner's Equity- 90,000

- $200,000

- $110,000

- $290,000

The following are components of Nigeria's financial system except?

- Financial Institution

- Financial Markets

- Financial Instruments

- Financial Meddling

One of the following is an example of non-banking institutions?

- Capital Market

- Insurance Firm

- Money Deposit bank

- Microfinance Bank

When any entry is made on both sides of cash book, it is called…………

- a) General entry

- b) Double entry

- c) Contra entry

- ) Compound entry

- *##**##*

Which of the following is not an accounting professional body?

- ) CIBN

- b) ANAN

- c) ICAN

- d) ICAEW

All ordinary shares are participating in nature but not all preference shares are participating. This means that?

- All Ordinary shares are not equity owners

- All preference shares can vote and be voted for in choosing directors

- All ordinary shares have the right to take part in the management of the business

- All preference shares are debtors of the business

Which of the following best describes the meaning of "Purchases

- a) goods bought for consumption

- b) goods bought on credit

- goods bought for re sales

- goods paid for

Assets minus Liabilities equals to [Blank].

- Owners' Equity

How would an accountant record an increase in sales?

- debit

- credit

A machine which was bought on 1st January 2015 for N40,000.00 It was expected to spend four yrs. It was revalued at the end of 2015 at N35,000.00 the value of depreciation is -------.

- N6,000.00

- N5,000.00

- N4,000.00

- N3,000.00

The company purchases land by paying half in cash and signing a note

- Assets (NE)

- Liabilities (I)

- Equity (I)

Bad debts written off is shown as

- Debit in sales ledger

- Debit in purchases ledger

- Credit in sales ledger

- Credit in purchases ledger

The double entry principle completed within the cash book is ……

- a) contra entry

- single entry

- c) folio column

- d) bank column

What is the normal Balance of Accounts Receivable?

- Debit

- Credit

The accounting equation for asset is …………….

- Option 1

- Option 2

- Option 3

- Option 4

One of the following is not an Operators of Nigeria Financial System?

- Federal Ministry of Finance

- Central Bank of Nigeria

- Tutor Generals of Education

- The Nigeria Deposit Insurance Corporation

Use the following to answer questions 60 - 62 NSales 35,000Purchases 20,000Closing stock 10,050Carriage outwards 650.00Carriage inwards 400.00Returns outwards 100.00Returns inwards 200.00Salaries 600.00Wages 400.00 Calculate the gross profit.

- N24,550.00

- N24,150.00

- N24,350.00

- N23,950.00

The term "folio" in account means -----

- a page in the ledger.

- an account in the book.

- a page in the book.

- a page in file.

What is the normal Balance of Notes Payable

- Debit

- Credit

Accounting is referred to as the "language of ___________________."

- profit

- life

- accounting

- business

What is the interest of the owners in the business known as?

- Assets

- Owner's Equity

- Liabilities

- None of the above

Assets and expenses are posted on which side of a trial balance

- a) credit

- b) debit

- detail

- D) Total

The concept that shows separation between owner and his business is ………

- a) post payment

- prepayment

- c) purchase

- d) accrual

Assets = Liabilities + Owner's EquityAssets - ?Liabilities- 25,000Owner's Equity- 100,000

- $125,000

- $25,000

- $100,000

When shares are issued at discount, this means that?

- The company makes loss

- The company makes gain

- The company gives out shares for nothing

- The company sell share without loss or gain

To keep up this site, we need your assistance. A little gift will help us alot.

Donate- The more you give the more you receive.

Related SubjectVenture Capital

Public Finance

Hospitality Management

Mobile Programming

Management Accounting

Financial Analysis and Reporting

Cost Accounting and Control System

Income Taxation

Treasury Management

Accounting Information System

Bookkeeper and Clerk

Intermediate Accounting

Tax Accounting Assistant

Super Micro's Accounting Irregularities

Introduction to Information Systems

Economics

Engineering Economincs

Project Management

Personal Finance

Show All Subject

Affiliate Links

Shopee Cashback Voucher

Temu $0 Shipping Fee

Amazon 75% Off Discounts